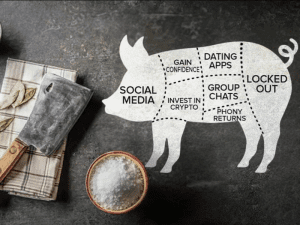

In today’s digital age, receiving an unexptected check in the mail can be both exciting and concerning. However, it’s crucial to approach these situations with caution, as many of these checks could be part of a fake check scam. Here’s how you can protect yourself and avoid becoming a victim of this growing issue.

Firstly, remember that companies rarely send checks without explaining why they issued them. If you receive an unexpected check, don’t cash it. You could be liable if it’s fraudulent. Legitimate companies do not overpay and ask you to send back the difference. Be wary if communication is only happening through social media or messaging apps, as reputable businesses typically use professional channels. Hiring managers will not sure personal emails to conduct business matters.

If you’re uncertain about a check, don’t hesitate to call the company directly to verify its legitimacy. Keep in mind that some fake checks may include a real company’s account number and routing number. It’s important to use a telephone number you obtain from an official source, not one found on the check itself.

Be vigilant and look out for the following red flags indicative of fake check scams:

- Typos: Pay attention to online job postings, texts, or emails that contain poor grammar and spelling errors

- Mismatched Names: Compare the name of the person or company posting the job opportunity with the name listed on the check.

- Pressure to Act Quickly: Fake checks can take about 10 days or more before your financial institution identifies them as counterfeit. Do not withdraw, wire, or transfer any funds until you have confirmed the check has cleared.

By knowing these warning signs and taking proactive steps, you can steer clear of fake check scams and safeguard your finances. Stay informed, stay safe!