Scam Alert: What You Need to Know to Stay Protected

Published on January 30, 2025

How Do I Know If I’m Talking to a Scammer?

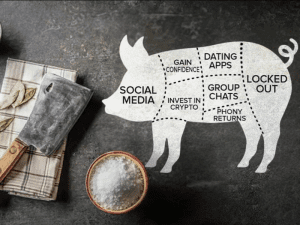

Know the signs of a scam. The internet has made communicating with others much easier, but it also makes it easier for scammers to find new victims. Scammers are constantly looking for people to take advantage of and always coming up with new ways to fool people. Scammers can quickly contact people and try to defraud them, whether through email, text messages, social media, phone calls, or postal mail.

They contact you unexpectedly. One of the most obvious signs to spot a scammer is if they reach out and contact you first. If you receive a message from somebody you don’t know, you can verify the message’s authenticity by calling the business directly. If somebody you do not recognize calls and says they are from TEGFCU and requests this information or your account details by phone, do not share any information and hang up immediately. Call TEGFCU at 845.452.7323 and press option zero to speak to our Solution Center and verify the call was legitimate.

ALWAYS REMEMBER: TEGFCU Will NEVER Ask You For Your Login Credentials or Temporary Passcode!

Protecting your finances is our priority. It’s crucial to understand how scammers operate so you can safeguard your accounts. TEGFCU will NEVER contact you directly to request your account information, login credentials, or temporary passcodes. This includes requests via phone, text, email, or any other method.

How Scammers Gain Access to Your Account:

- Phishing: Deceptive emails, texts, or websites that mimic legitimate institutions to trick you into revealing your login details.

- Hacked Emails or Social Media: Compromised accounts can expose your personal information, including passwords.

- Malware/Viruses: Malicious software can steal data from your devices, including login credentials.

- Data Breaches: Companies you interact with might experience data breaches, exposing your information.

- Dark Web: Stolen data, including usernames and passwords, is often sold on the dark web.

- Social Engineering: Manipulative tactics used to trick you into divulging sensitive information.

Two-Factor Authentication (2FA): A Critical Layer of Security

2FA adds an extra layer of protection to your online accounts by requiring a second form of verification, such as a code from your phone or a fingerprint scan, in addition to your password. This makes it much harder for scammers to access your account even if they have your password.

How Scammers Try to Bypass 2FA:

While 2FA significantly enhances security, scammers are constantly evolving their tactics. Social engineering remains a common method. They might contact you pretending to be a representative from TEGFCU or another trusted organization, claiming an urgent issue with your account and requesting your verification code. Remember, TEGFCU will NEVER ask you for these codes.

TEGFCU’s Commitment to Your Security:

We will NEVER ask you for your:

- SSN

- Credit or Debt Card numbers

- Security Code or CVV

- PIN

- Address

- Date of Birth

- Digital Banking Login Information

- Verification Codes

- Mother’s Maiden Name

- Passwords

If you are contacted by anyone requesting this information, DO NOT provide it. Hang up or disregard the communication immediately and contact TEGFCU directly using our official contact information.

Stay Vigilant:

Be cautious of any unexpected communications, even if they seem legitimate. Think before you click on links or provide any personal information. If you have any doubts, contact TEGFCU directly.

For additional information on how to protect your personal information and sensitive data from these types of attacks, visit the Federal Trade Commission.

More Recent Posts