Romance scams are on the rise, and unfortunately, a growing number of people – including credit union members – are falling victim to them. These scams don’t just break hearts; they can also result in significant financial losses. That’s why understanding how they work and how to protect yourself is so important.

What are Romance Scams?

A romance scam happens when a criminal creates a fake online identity to establish a romantic – or seemingly close – relationship with their victim. This relationship is a carefully crafted illusion designed to manipulate and often steal from unsuspecting individuals.

Here’s how it typically works:

- The scammer quickly develops the relationship to earn your trust.

- They’ll often profess love, propose marriage, or make plans to meet in person – but these promises will never come true.

- Eventually, they’ll ask for money, often with convincing stories about medical emergencies, legal troubles, or other crises.

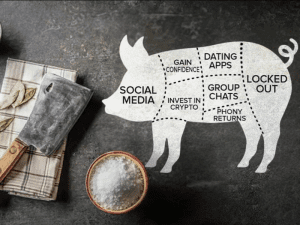

Romance scammers are professionals. They appear to be genuine, caring, and completely believable. Many operate on dating platforms, social media sites, or even through messages sent out of the blue.

Why Romance Scams Feel Real

These con artists are experts at creating elaborate, believable backstories. A common tactic is to claim they work in the building or construction industry and are on a project overseas. This excuse conveniently explains why they can’t meet in person and sets up a plausible reason for needing financial assistance.

For example, they might say:

- “I’m stuck abroad due to unpaid expenses for my project.”

- “I need funds for a sudden medical emergency.”

- I’m dealing with unexpected legal fees and my accounts are frozen.”

Even worse, some scammers ask for victims’ account information, claiming they need it to deopsit money. But in reality, they’re likely using your account to commit fraud or carry out other illicit activities.

Tips to Avoid Romance Scams

The FBI has shared valuable advice to help individuals stay safe. Here are some tips to protect yourself from these schemes:

Be Cautious with Your Online Presence

The more you share on social media or dating platforms, the more information scammers can use to target you.

Do Your Research

Use reverse image searches for their photos or cross-check their profile details. if you find their photo or name in multiple places with different stories, it’s a red flag.

Take Things Slow

Don’t rush into trust. Ask lots of questions, and be wary if they seem too perfect or push for immediate communication off the platform.

Look Out for Isolating Behavior

Scammers often try to isolate their victimes by discouraging them from talking to friends or family. If they as for private photos or sensitive financial information, it’s a major warning sign of potential extortion.

Watch from Broken Promises to Meet in Person

Many scammers will repeatedly promise to meet you but always come up with excuses. If months pass without a metting, it’s time to reevaluate the situation.

Never Send Money to Someone You Haven’t Met

This is the golden rule. No matter how convincing or urgent their story may seem, sending money to someone you’ve only interacted with online is never safe.

Protect Your Finances and Your Heart

A romance scam preys on emotions, but the consequences often have a significant financial impact. If you or someone you know is being asked for money or personal account information by someone you’ve only met online, it’s critical to stop and think before acting. Ask yourself:

- Have I shared too much personal information?

- Does this person’s story seem too smooth of “too perfect”?

- Have they tried to isolate me from my support network?

Recognizing the red flags early can save you from heartbreak – and protect your finances.

If you suspect you’ve encountered a romance scam, consider reaching out to someone you trust or reporting it to the appropriate authorities, like your financial institution or the FBI.

Stay Vigilant, Stay Safe

If you are contacted by anyone requesting this information, DO NOT provide it. Hang up or disregard the communication immediately and contact TEGFCU directly using our official contact information.

Be cautious of any unexpected communications, even if they seem legitimate. Think before you click on links or provide any personal information. If you have any doubts, contact TEGFCU directly.

For additional information on how to protect your personal information and sensitive data from these types of attacks, visit the Federal Trade Commission.