This growing imposter threat is targeting Financial Institutions.

The FBI is warning the public about a rapidly growing wave of dangerous imposter scams known as the “Phantom Hacker” attack, which is currently targeting Apple and Android products. This Phantom Hacker Financial Scam relies on a spoofed call from a victim’s bank, tricking them into transferring money to a new account to safeguard it from being stolen by a non-existent (phantom) hacker. Scammers often spoof caller ID information, so fraudulent calls appear to be coming from a legitimate phone number.

A financial institution will never ask you to move money. Unsolicited calls should be an obvious red flag, but in the moment with a well-versed scammer on the phone, it can be all too easy to fall victim. These scams can lead to significant financial losses.

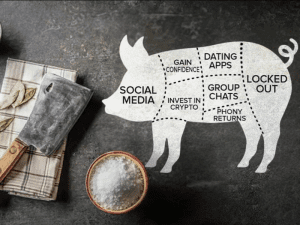

Here’s how it works:

Scammers call unsuspecting victims, posing as banking representatives. They claim that hackers have infiltrated the victim’s account, and that immediate action is needed to protect their funds. The scammer pressures the victim, urging them to act quickly to save their money. To do so, they suggest downloading an app that will allow a fast transfer of funds.

But there’s a catch. Once the app is downloaded, the scammer gains remote access to the victim’s device. The victim believes they are protecting their funds, but the scammers now have complete control to steal money directly from their accounts, and then money is transferred to the scammer’s account instead. Some victims are losing their entire life savings.

The FBI reports that while variations of this scam exist, they all rely on the same tactic: creating a sense of urgency and tricking victims into acting without thinking.

How to Protect Yourself:

- Disconnect immediately if you receive an unsolicited call (text, email, or pop-up) about suspicious activity in your bank account.

- Do not download any apps or software at the request of an unknown individual who contacted you.

- Do not grant remote access to the person who wants to get control of your phone or computer.

- Contact your financial institution directly using a verified number to inquire about any suspicious activity on your account.

- Be wary of high-pressure tactics. No legitimate institution will ask you to move your funds via a phone call or unsolicited app download.

Reporting Suspected Fraud:

If you suspect you’ve been targeted by a scam, report these fraudulent or suspicious activities to the FBI Internet Crime Complaint Center (IC3) at www.ic3.gov. Be sure to include as much information as possible, such as:

- The name of the person or company that contacted you.

- Methods of communication used include websites, emails, and telephone numbers.

- The bank account number where the funds were wired to and the recipient’s name(s).

Fraud tactics are always evolving, but TEG is here to help. Our blog and website offer the latest fraud alerts, security tips, and ways to protect your personal information. Stay informed, stay safe, and stay secure!