At TEGFCU, keeping you informed and staying ahead of scammers is part of how we protect our members. Your security is our top priority. Today’s fraudsters are more sophisticated than ever. They use artificial intelligence (AI) to impersonate trusted companies, organizations, and even loved ones. Their goal? To trick you into sending money or sharing personal information through AI-powered scams.

How to Outsmart AI-Powered Fraudsters

Scammers are leveraging AI to create emails, texts, and phone calls that look and sound legitimate, making it harder to detect their fraudulent nature. They are masters at producing highly convincing impersonations of individuals or organizations, such as your financial institution, the IRS, or a well-known tech company. It’s crucial to stay informed and vigilant. By learning the red flags and trusting your instincts, you can keep your money and your information safe.

Watch Out for These Growing Scams

- Phantom Hacker Scams: In these scams, scammers pretend to be financial institutions, tech support, and government officials. They trick victims into believing their financial accounts have been compromised by non-existent hackers. Victims are then convinced to move their money to a “safe” account controlled by the scammers.

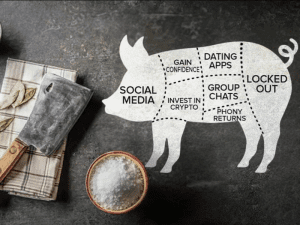

- Pig Butchering Scams: These long-term cons start with a friendly message or romantic interest. They then slowly “fatten” the victim with trust before convincing them to invest in fake crypto platforms or financial schemes. Eventually, the scammers vanish with their funds.

Tips to Stay Safe:

✔️ Verify Before You Act

Never respond to unexpected requests for money or personal information. Instead, pause and verify the message directly with the source—use a trusted phone number or official website.

✔️ Don’t Click Suspicious Links

If you receive an email or text that feels off or too good to be true, don’t click any links. These could lead to phishing sites that steal your information.

✔️ Be Cautious with Digital Payments

Digital payment apps like Venmo, and wire transfers are common targets for scammers. Once the money is gone, it can be hard—or impossible—to get it back.

✔️ Keep Your Personal Info Private

Never share your online banking passwords, one-time passcodes, or personal details unless you initiate the contact. TEG will never call, email, or text asking for this information.

✔️ Trust Your Gut

If something feels off, it probably is. Take a moment, step back, and double-check.

✔️ Report Suspicious Activity

If you think you’ve been targeted, contact us immediately and report the scam to the appropriate authorities. The sooner you act, the better.

✔️ Stay Informed

Fraud tactics are always evolving, but TEG is here to help. Visit our blog and website often for the latest fraud alerts, security tips, and ways to protect yourself.