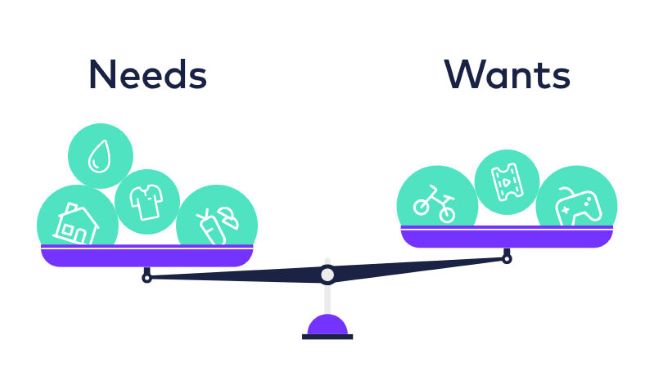

What is a “want?” And what is a “need?” While everyone has their own wants and needs, being able to differentiate between financial wants vs. needs can be difficult. Being able to clearly define each can help you improve your savings, which can help you build up an emergency fund, pay off debt, or fund long-term savings goals.

Generally speaking, a “need” is something you absolutely cannot live without. You need a roof over your head, for example. You need food, water and transportation to get to work.

You need electricity in your house, you need food to eat and you need a telephone. In present day, you probably even need internet access for your job or so your kids can do virtual schooling.

A “want,” on the other hand, is something you’d like, but could probably live without if push comes to shove. You want to go out to dinner tonight so you don’t have to cook. You want a shiny new iPhone X, even if your existing phone works just fine. A want is something you very well may be able to afford, but don’t actually need to get by.

Differentiating between real needs and wants helps tremendously. People get into financial trouble when they begin spending too much on unnecessary things. Limit your spending to the things you really need and can realistically afford.

If you’re struggling to separate wants from needs, here are three steps to help:

Step 1: What truly adds value to your life?

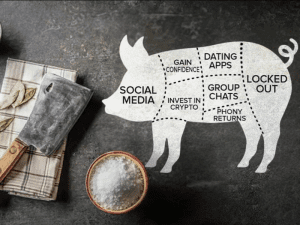

If you’re spending more than you should and are having trouble separating wants from needs, it’s smart to take a step back and look at what you’re actually buying. Do your wants add real value to your life, or are they made out of convenience? Are you making discretionary purchases because they’re important to you, or simply out of habit?

While spending on wants is an important part of life, some wants are more important to us than others – and if you stop to examine your spending, you may find that many of the splurges you’re making aren’t really worth it. That daily stop for you coffee during the work week that only costs you $2 a cup, 5 times a week for an entire month actually is costing you $40.

Step 2: Trade away some of your wants for a better deal.

Depending on the “want” in question, you may be able to come up with an alternative action that lets you save your money instead. This is a good strategy to try when you’re spending on something out of habit or out of convenience.

For example:

If you dine out a few times per week more out of convenience than pleasure, you may find you can cut your spending and still eat conveniently with some simple planning. If you can get in the habit of meal planning or using your crock pot to make easy dinners a few nights per week, for example, you may be able to avoid hasty, unfulfilling dinners out and pocket that money instead.

If you have an expensive cable package out of habit but never watch all the channels, you may be able to choose a cheaper package and save money without really noticing. Heck, you may even be able to cancel your cable subscription together.

If you’re signed up for multiple subscriptions you may be spending more than you actually think. Do you have a Netflix account? Spotify or Pandora? Do you stop daily for a morning coffee? Small purchases such as these can impact your budget significantly if you’re not keeping track.

Step 3: Figure out how to afford what you really want.

Let’s say you have a handful of wants that are really important to you. You enjoy your new car for long commutes or you’re a tech enthusiast eager for the latest gadgets. Are you a foodie who dines out so often you’d cut costs elsewhere to enjoy your favorite restaurants?

Why is it important to recognize the difference between financial needs and financial wants? Understanding your needs and wants leads to better spending decisions, improving your financial situation.

By distinguishing needs from wants, many realize they can comfortably pay bills even on a modest income. You can make your money go further when you put your needs first.