There comes a time when everyone needs to start prioritizing their credit score. Whether you’re applying for a credit card or a loan, your credit score impacts your ability to access these products. There are five major factors to consider, often referred to as the 5 C’s of credit, when you’re improving your credit score. Character, Capacity, Capital, Collateral and Conditions are concepts you need to familiarize yourself with, but let’s focus on the second C, Capacity.

There are many strategies to improve your credit score. Let’s dive into how capacity helps.

What is Credit Capacity?

Credit capacity refers to the balance versus limits on a person’s credit cards and lines of credit. Lines of credit may include cash lines, overdraft lines and HEQ lines of credit. In this theoretical scenario, you can see the relationship between limits and balances. If you have $10k in limits and $4k in balances, you’ll have a capacity of 60 percent, with 40 percent utilized.

It’s imperative to understand balance versus limits in relation to credit capacity. Your limit is your available credit; your balance is what you owe. Because of this, balance and limits play a significant role in your credit score. The recommended credit card usage should be ideally below 30 percent.

Income is one of the most prominent factors of credit capacity, as it determines your credit limit. This ties into lender exposure risk, which according to investopedia.com, can be defined as “Exposure is the maximum potential loss a lender may incur if the borrower defaults. It’s a risk assessment technique that evaluates the lender’s position, the borrower’s characteristics, and the loss potential. Analyzing the lender exposure risk and your income will make it easier to obtain the loan you want. And everything comes down to your ability to repay debt. If you can’t repay, getting the loan or credit card you want will be harder.

If you don’t pay your credit card on time or maintain a negative balance, your credit score will decrease.You may be wondering, “how long does it take to improve credit score?” The answer to this varies based on your credit usage.

What’s a Good DTI Ratio?

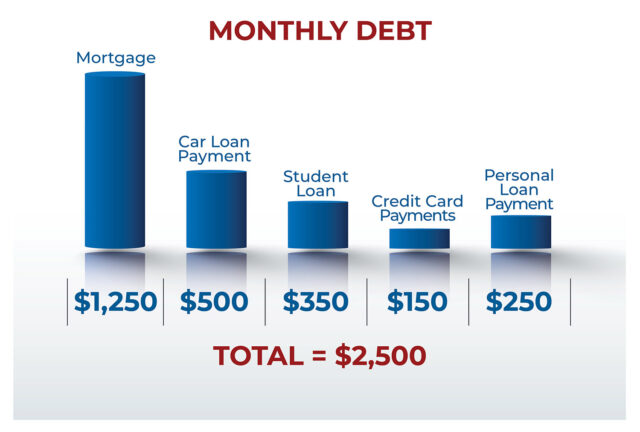

Lenders easily calculate the DTI ratio. If you’d like to assess your DTI for yourself, add up your monthly debts and divide by your income. Reflect the DTI ratio as a percentage. Lenders consider a 40-44 percent debt-to-income ratio as good, and they see anything under 40 percent as excellent.

You can use a debt-to-income ratio calculator, or follow these helpful steps.

Here’s an example to see how easy it is to calculate the DTI ratio

Perhaps your DTI ratio exceeds the 40 percent mark, so how do you improve your credit score and lower your DTI? There are several ways to lower your DTI. One of the more obvious solutions is to increase your income, but because not everyone is in the position to do so, there are easier ways to do this. Contributing more to paying a debt can help lower your debt overall. With this in mind, avoid taking on more debt and refrain from making large investments for now.

WAYS TO IMPROVE YOUR CREDIT CAPACITY

- Increase your Income

- Pay Off your Debts

- Avoid Unnecessary Spending

- Consolidate Your Debts

A DTI greater than 45 percent is considered a cautious zone. And DTI’s over 50 percent are viewed as high risk for the potential lender. Because DTI is only calculating your gross income, the ratio doesn’t factor in any additional expenses that aren’t on your credit report. These expenses can include a mobile phone bill, car insurance, cable bill, and the taxes taken from your pay.

“The most rewarding part of working in my role at TEGFCU is helping members realize their credit score potential. Showing them how to understand their score and develop a plan to increase their score never gets boring. Celebrating when the goal is achieved is very gratifying for all of us involved.”

Shelby Watson, Branch Manager.

How Can TEG Help You?

TEG can help by doing a Credit Bureau Review. Sitting down with any of our trained credit experts and reviewing your credit report for ways to improve and understand your credit score can help you save money and grow your score in as little as 90 days.

Visit your local branch to receive this service from TEG’s trained specialists.