0% financing on a car loan almost sounds too good to be true. It seems like the best deal on the surface, but is it really?

The truth is, 0% financing through a dealership can actually cost more than a low APR loan through a credit union. For this reason, comparing auto loan interest rates and other loan terms before you buy is the wisest thing you can do.

So what is a good APR for a car? How can you know you are getting the best deal? Read on to find out more about 0% financing and other more attractive loan options.

What Is 0% Financing?

In short, 0% financing is a loan typically offered through an automotive dealership’s financing department. It means that you will pay no interest over the lifetime of your loan.

Paying no interest can save you thousands over the life of your loan and lower your total out-of-pocket cost for your car. Low rates can help you reduce your monthly payments, afford a more expensive car, or pay off your loan faster.

Before you jump at a 0% offer from an auto dealer, let’s explore a few reasons why 0% financing might not be the best financing option for you.

0% Financing Gives You Fewer Options

For many dealerships, 0% financing deals are only offered on some of their harder-to-move cars. This could be last year’s model, a vehicle that has been plagued by recalls, or simply an unpopular car. They are also typically only available on new cars, and not on certified used vehicles.

If you want to be able to choose your car from any available vehicle on the lot without worrying about financing terms, obtaining your financing from a local credit union is your best bet.

In addition, many consumers don’t qualify for 0% financing due to their credit scores. Most dealerships require a fairly high credit score (typically above 700) in order to get the best deal. And the alternatives for those who don’t make the cut can be pricey. But you won’t know if you make the cut until they pull your credit.

You also lose the ability to negotiate when you accept a 0% financing offer. When you’re already getting a no-interest loan, it may be impossible to reduce the price of the vehicle or get free add-ons, upgrades, and other incentives.

Dealer Fees & Markups Can Lower The Appeal of 0% Financing

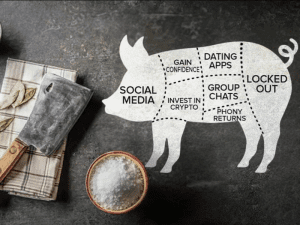

Sure, it seems like you’re getting a great deal with that 0% financing offer, but how much is it saving you if the dealership is tacking on hundreds of dollars in fees and other markups? In addition, some 0% interest loans include terms that allow the dealership to begin charging astronomically high interest rates if you miss even one payment.

Dealerships are experts at their sales tactics, and 0% financing is often just a way of simply moving the cost of the interest rate into other costs such as administrative fees. Good thing getting a 0% interest rate from a dealer on your car loan isn’t your only option.

Alternatives to 0% Financing

If you are starting to wonder if the dealership’s 0% might not be best for you and looking to explore your options, what type of loan terms should you be looking for? If you go with a local credit union, you can expect to see annual percentage rates (APRs) from between 3-7%; if you have excellent credit, financing can sometimes be obtained for as low as 2% APR.

It is important to carefully look at the terms of a loan before simply agreeing to the offer with the lowest APR. For example, let’s say you are looking to finance a vehicle with a $25,000 MSRP. You may get an offer from the dealership for no-interest financing on a loan for $30,000 over a 60-month term. At 0% interest, your payments will be $500 per month.

A different financial institution might offer a 60-month auto loan with 5% interest. The interest rate is higher, but they will loan you the $25,000 you need for your vehicle. With this offer, your monthly payment is $472, saving you $28 each month, even with a higher interest rate. And if you get an interest rate lower than 5%, your payment will be even lower.

As you can see, “0% interest” is commonly nothing more than a marketing technique to drive sales. They are offering lower interest rates in exchange for raising the sales price, which doesn’t work in your favor.

Credit union loans offer benefits like flexible repayment periods, low down payments, and financing for those with poor credit.

Use cash back and rebate offers to save more than 0% financing. Compare dealership offerings to find out which saves the most money and which is just a gimmick.

Comparing interest rates and focusing on a good APR is crucial for car loans.

Compare Rates and Find a Good APR Here!

At TEG Federal Credit Union, we’ll help you find the right loan for your needs. TEG offers great rates and fast approvals on loans for all types of vehicles, from ATVs to used vehicles. Contact us today to learn more about our First Time Borrower Vehicle Loans and other financing products!